Since he joined the FHFA, Pulte has pursued changes to the current credit score requirements by the government-sponsored enterprises. His comments were directed to Fair Isaac Corp. (FICO), which licenses one of the most widely used credit-risk assessment tools in the mortgage industry.

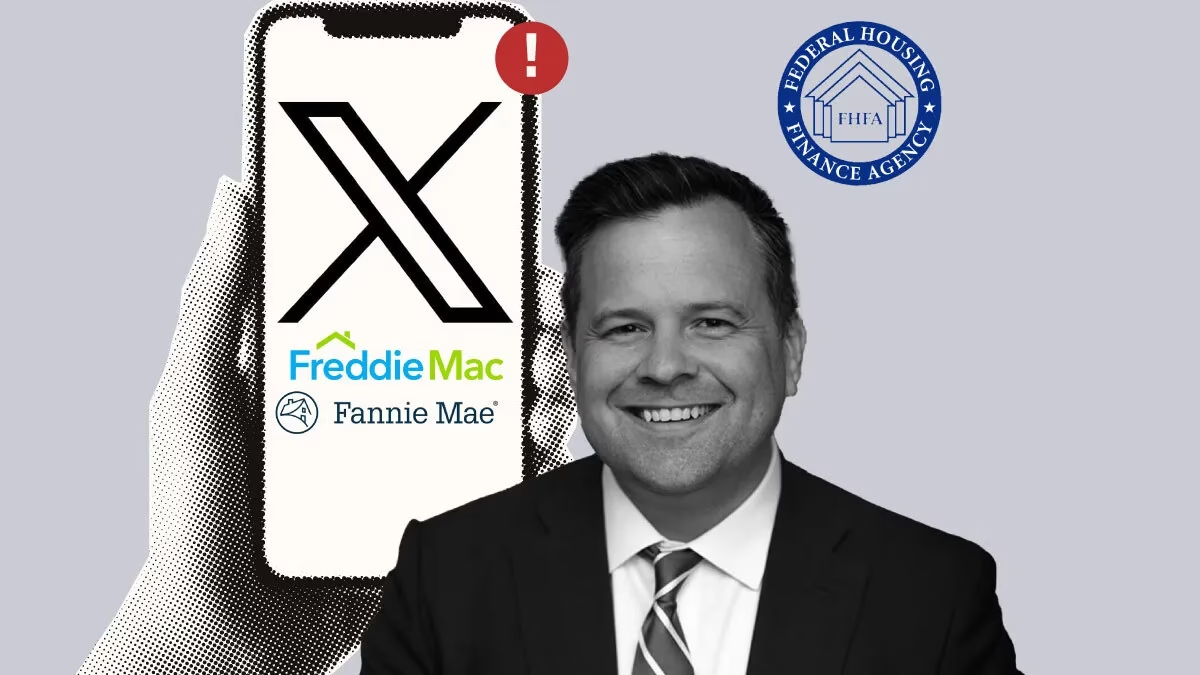

In a Tuesday morning post on social media platform X, Pulte said that effective Tuesday, “to increase competition to the Credit Score Ecosystem and consistent with President Trump’s landslide mandate to lower costs, Fannie and Freddie will ALLOW lenders to use Vantage 4.0 Score with no current requirement to build new infrastructure (stays Tri Merge).”

Pulte’s comments follow social media posts he made in May questioning why some credit reports have doubled in cost. He also expressed frustration with the pricing structure.

“After the hard work by many great Senators, including Senator Tim Scott, I am extremely disappointed to hear about the cost increases by FICO onto American consumers.”

FiCO’s stock declined sharply after his comments in May, dropping roughly 25%.

It’s not entirely clear if the agencies will eventually move to a bi-merge credit reporting score in underwriting models. Under the Biden administration, there was an initiative to move to two credit reporting agencies to increase competition and lower costs on Fannie Mae and Freddie Mac-purchased loans.

The FHFA has mandated the use of VantageScore 4.0, alongside FICO Score 10 T, for GSE-purchased mortgages. Mortgage lenders were to begin delivering VantageScore 4.0 scores for newly originated loans in Q3 2024, with full implementation scheduled for the fourth quarter of 2025, but it was pushed back indefinitely.

VantageScore estimates that using their credit model will result in approximately 33 million more consumers nationwide having access to a credit score that may aid them in obtaining a mortgage.

In another social media post, Pulte said the change would expand “credit access to millions of forgotten Americans — people who live in rural areas, renters who pay their rent on time every month — and bringing down closing costs.”

Leave a Reply